The France-based NGO Just Sustainability Transitions (JuST) Institute is holding an online session December 12 to educate potential participants about a mentoring and training program for financial services providers (FSPs) looking to orient their work toward “climate adaptation and biodiversity conservation.” The program, which is for loan officers and managers employed by microfinance institutions (MFIs), takes place online over a period of four to six months. Participation can be part of an MFI becoming certified for

The France-based NGO Just Sustainability Transitions (JuST) Institute is holding an online session December 12 to educate potential participants about a mentoring and training program for financial services providers (FSPs) looking to orient their work toward “climate adaptation and biodiversity conservation.” The program, which is for loan officers and managers employed by microfinance institutions (MFIs), takes place online over a period of four to six months. Participation can be part of an MFI becoming certified for

Category: Client Protection

SPECIAL REPORT: Partner with Agents for Impact, and We’ll Drive Impact Together!

This article is sponsored by Agents for Impact (AFI). We invite you to learn more about the firm via LinkedIn.

Andrij Fetsun, Founder & CEO at AFI:

Andrij Fetsun, Founder & CEO at AFI:

AFI celebrated five years in business in October this year, and my team has attained several impactful goals during this challenging time. This would not have been possible without the immense support of our clients: the German impact-driven microfinance fund Invest in Visions, which has accumulated a volume of around EUR 1 billion with a major focus on microfinance; HANSAINVEST, which is based in Hamburg; and the crowdfunding platform Lendahand. Among the services we provide these clients is to perform plausibility checks of their funds’ ESG reports.

As the founder of AFI, I would like to highlight the culture we have built with our dedicated team that has come together during these five years from different parts of the world. I believe that corporate culture is crucial for every company, especially for startups. Initially, we had trouble attracting Agents since we were not a well-established name in the industry or able to pay high salaries from the outset. Therefore, I focused on what truly makes for a great workplace

As the founder of AFI, I would like to highlight the culture we have built with our dedicated team that has come together during these five years from different parts of the world. I believe that corporate culture is crucial for every company, especially for startups. Initially, we had trouble attracting Agents since we were not a well-established name in the industry or able to pay high salaries from the outset. Therefore, I focused on what truly makes for a great workplace

MICROFINANCE PAPER WRAP-UP: “Gendered Investment Differences Among Smallholder Farmers: Evidence from a Microcredit Programme in Western Kenya,” by Keiji Jindo et al

The authors of this study conducted a client-level analysis to examine differences in the investment behavior of female and male microcredit users in Kenya. The scope included

The authors of this study conducted a client-level analysis to examine differences in the investment behavior of female and male microcredit users in Kenya. The scope included

MICROFINANCE EVENT: Consumers International Global Congress; December 6-8, 2023; Nairobi, Kenya

Every four years, this event gathers stakeholders aiming to create a resilient future for the mass market. The agenda covers topics such as: (1) Transforming Consumer Journeys in Mobile Money; (2) The Influence of ChatGPT on Consumer Experiences; (3) Channels of

Every four years, this event gathers stakeholders aiming to create a resilient future for the mass market. The agenda covers topics such as: (1) Transforming Consumer Journeys in Mobile Money; (2) The Influence of ChatGPT on Consumer Experiences; (3) Channels of

SPECIAL REPORT: European Microfinance Week 2023 Opens With Action Group Meetings, Including Investors Sharing Strategies for Measuring Social Performance #EMW2023

The first day of European Microfinance Week 2023 began this morning with meetings of several of the European Microfinance Platform’s (e-MFP’s) Action Groups. At the Investors Action Group session, Cécile Lapenu of CERISE discussed the recent increase in demand for accountability regarding claims of positive client impact. What really makes an investor an impact investor? How can we measure impact in a way that is convincing and also efficient?

The first day of European Microfinance Week 2023 began this morning with meetings of several of the European Microfinance Platform’s (e-MFP’s) Action Groups. At the Investors Action Group session, Cécile Lapenu of CERISE discussed the recent increase in demand for accountability regarding claims of positive client impact. What really makes an investor an impact investor? How can we measure impact in a way that is convincing and also efficient?

The recently published 60 Decibels Microfinance Index 2023 addresses some of these questions. The study, which is based on a survey of 32,000 microfinance clients in 32 countries, indicates that access to financial and non-financial services other than credit leads to deeper impact. Regarding credit services, group lending is associated with

SPECIAL REPORT: European Microfinance Week 2023 Is Almost Here! A Tour of the Upcoming Conference’s Sessions and Streams

European Microfinance Week (EMW) 2023, taking place in Luxembourg from 15-17 November, is fast approaching! One of the sector’s premier knowledge-sharing and networking events, EMW welcomes more than 500 professionals, in-person and online, and this year will comprise over 40 sessions – plenaries, breakouts, closed-door roundtables and Action Group meetings – organised across several thematic streams. These include: ‘Inclusive Finance for Food Security & Nutrition’, Green and Climate-smart Finance, Refugees and Forcibly Displaced Persons, Digitalisation, Investing, Financial Health, Client Protection, and Outcomes & Impact, among others. Here is a selection of what attendees can expect:

European Microfinance Week (EMW) 2023, taking place in Luxembourg from 15-17 November, is fast approaching! One of the sector’s premier knowledge-sharing and networking events, EMW welcomes more than 500 professionals, in-person and online, and this year will comprise over 40 sessions – plenaries, breakouts, closed-door roundtables and Action Group meetings – organised across several thematic streams. These include: ‘Inclusive Finance for Food Security & Nutrition’, Green and Climate-smart Finance, Refugees and Forcibly Displaced Persons, Digitalisation, Investing, Financial Health, Client Protection, and Outcomes & Impact, among others. Here is a selection of what attendees can expect:

‘Inclusive Finance for Food Security & Nutrition’ is the topic of the European Microfinance Award 2023, the €100,000 prize awarded annually by the Luxembourg Ministry of Foreign and European Affairs, which this year seeks to highlight innovations by financial services providers (FSPs) to safeguard access to quality and affordable food for vulnerable populations and to increase resilience of food systems. EMW2023 attendees will be able to choose from a range of sessions addressing the different dimensions of food security, including:

- An opening plenary to kick off this session stream, which will bring together different perspectives from key stakeholders to address holistically the current challenges in the field and discuss the role of FSPs in food security and building sustainable food systems;

- Creating Supportive Ecosystems to Maximize Supply of Agricultural Products Through Investments and Technical Assistance will focus on

SPECIAL REPORT: Inclusivity in Capital Markets Demands Sustainability Reporting

Sustainability reporting entails assessing, disclosing and managing an organization’s environmental, social and governance (ESG) impacts. This practice communicates to investors, customers, employees and regulators that the organization is committed to sustainability. The disclosure element, in particular, conveys values, strategies, risks, opportunities, accountability and transparency.

Sustainability reporting entails assessing, disclosing and managing an organization’s environmental, social and governance (ESG) impacts. This practice communicates to investors, customers, employees and regulators that the organization is committed to sustainability. The disclosure element, in particular, conveys values, strategies, risks, opportunities, accountability and transparency.

The significance of sustainability reporting within capital markets is increasing steadily, as more investors

MICROFINANCE PAPER WRAP-UP: “Establishing a Financial Services Ombudsman in Mongolia: Experiences and Lessons from Armenia, Australia and Singapore,” by Massimiliano Gangi et al

This paper explores the potential of introducing an independent ombudsman system to address complaints by consumers against financial services providers (FSPs) in Mongolia by exploring existing dispute resolution systems in Armenia, Australia and Singapore.

This paper explores the potential of introducing an independent ombudsman system to address complaints by consumers against financial services providers (FSPs) in Mongolia by exploring existing dispute resolution systems in Armenia, Australia and Singapore.

Among the similarities of these three systems are:

MICROFINANCE PAPER WRAP-UP: “Determinants of Choice of Credit Source Among Clients of Microfinance Systems in the Upper West Region of Ghana,” by Paul Bata Domanban et al

The authors of this article examined which groups of people in northwestern Ghana were more and less likely to borrow money from microfinance institutions (MFIs). The authors conducted

The authors of this article examined which groups of people in northwestern Ghana were more and less likely to borrow money from microfinance institutions (MFIs). The authors conducted

MICROFINANCE EVENT: Global Forum on Remittances, Investment and Development (GFRID); June 14-16, 2023; Nairobi, Kenya

The eighth edition of this biennial event will begin with two days of sessions with titles such as: (1) Remittances and Diaspora Investment as Tools for

The eighth edition of this biennial event will begin with two days of sessions with titles such as: (1) Remittances and Diaspora Investment as Tools for

MICROFINANCE EVENT: Responsible Finance Forum; July 5-7, 3023; Bengaluru, India

Themed “Shaping a Responsible Digital Finance Ecosystem,” the upcoming edition of this event – the first in-person since 2019 – will focus on client protection to help “low-income and vulnerable” people reduce risks as they use financial tools. Although the detailed agenda has not yet been finalized, it is expected to include topics such as: (1) Balancing Responsible Finance Between

Themed “Shaping a Responsible Digital Finance Ecosystem,” the upcoming edition of this event – the first in-person since 2019 – will focus on client protection to help “low-income and vulnerable” people reduce risks as they use financial tools. Although the detailed agenda has not yet been finalized, it is expected to include topics such as: (1) Balancing Responsible Finance Between

MICROCAPITAL BRIEF: AMK of Cambodia Borrowing $7.5m for Green Microfinance via Bond Issue from BII, Symbiotics

Symbiotics Investments, a Switzerland-based investor focused on smaller businesses in low- and middle- income countries, recently disbursed USD 7.5 million to Cambodia’s AMK Microfinance Institution to fund its ongoing lending for electric two- and three-wheeled vehicles as well as new products, such as

Symbiotics Investments, a Switzerland-based investor focused on smaller businesses in low- and middle- income countries, recently disbursed USD 7.5 million to Cambodia’s AMK Microfinance Institution to fund its ongoing lending for electric two- and three-wheeled vehicles as well as new products, such as

MICROCAPITAL BRIEF: EBRD Loaning $5m to ING Finansal Kiralama for Leasing for Energy Efficiency, Renewables in Turkiye

The multilateral European Bank for Reconstruction and Development (EBRD) recently agreed to provide an unsecured loan approximately equivalent to USD 5.5 million to the Türkiye-based Internationale Nederlanden Groep (ING) Finansal Kiralama, which is controlled by the Netherlands-based ING Group. Also known as ING Leasing, the company plans to use the proceeds to finance

The multilateral European Bank for Reconstruction and Development (EBRD) recently agreed to provide an unsecured loan approximately equivalent to USD 5.5 million to the Türkiye-based Internationale Nederlanden Groep (ING) Finansal Kiralama, which is controlled by the Netherlands-based ING Group. Also known as ING Leasing, the company plans to use the proceeds to finance

MICROCAPITAL BRIEF: Activists Block Access to 3 Microfinance Institution Branches in Nepal, Accusing MFIs of Causing Over-indebtedness

Members of the Nepal Communist Party reportedly placed locks on the doors of two microfinance institution (MFI) branch offices in the western Nepali province of Sudurpaschim. Access to a third branch in the province also was blocked before police removed

Members of the Nepal Communist Party reportedly placed locks on the doors of two microfinance institution (MFI) branch offices in the western Nepali province of Sudurpaschim. Access to a third branch in the province also was blocked before police removed

SPECIAL REPORT: Agents for Impact – We Make Positive Impact Investable!

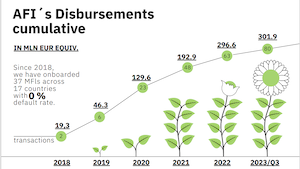

Founded in 2018, Agents for Impact (AFI) celebrates its fifth anniversary this year. This represents five years of continuous commitment to our mission, which is to build bridges between impact investors and financial services providers in developing markets across the world. Sustainability is central to our vision. We aim to create more investment opportunities by measuring risks (Risk), rendering impact measurable and comparable (Rating), and making sustainability and financial inclusion understandable for investors (Research).

Founded in 2018, Agents for Impact (AFI) celebrates its fifth anniversary this year. This represents five years of continuous commitment to our mission, which is to build bridges between impact investors and financial services providers in developing markets across the world. Sustainability is central to our vision. We aim to create more investment opportunities by measuring risks (Risk), rendering impact measurable and comparable (Rating), and making sustainability and financial inclusion understandable for investors (Research).

To acknowledge our jubilee, we kick off 2023 by looking back at our achievements and bringing some of our milestones to your attention. Since its inception, AFI has provided investment advice and recommendations on around USD 285 million in impact investing transactions. So far, we have done business in 16 countries across the globe, facilitating debt financing to 32 financial institutions (including one more since the December 2022 figures shown in the graph below!) – each of which was analyzed and selected according to strict standards of sustainability, alignment with a number of the UN’s Sustainable Development Goals (SDGs), and

MICROFINANCE PAPER WRAP-UP: “The Impact of Microfinance Institutions on Poverty Alleviation,” by Collin Chikwira et al, Published by Journal of Risk and Financial Management

The authors of this report reviewed evidence of the effects of microfinance institutions (MFIs) on poverty in developing economies. Although a number of

The authors of this report reviewed evidence of the effects of microfinance institutions (MFIs) on poverty in developing economies. Although a number of

MICROCAPITAL BRIEF: Copal App to Help Parents, Youth in Egypt to Manage Finances via Mastercard Payment Network

Copal, an Egypt-based financial technology (fintech) firm, recently entered a partnership with US-based payment processing corporation Mastercard to launch an app that helps families in Egypt to make payments and otherwise manage their finances. Plans for the app include

Copal, an Egypt-based financial technology (fintech) firm, recently entered a partnership with US-based payment processing corporation Mastercard to launch an app that helps families in Egypt to make payments and otherwise manage their finances. Plans for the app include

MICROFINANCE EVENT: Technology for Change Asia; March 20-21, 2023; Singapore

The third iteration of this annual event will focus on how technology “can be applied to long-standing social challenges to connect with the consumer.” The event offers virtual sessions on March 20 and in-person sessions on March 21 on topics including: (1) Unlocking the Power of

The third iteration of this annual event will focus on how technology “can be applied to long-standing social challenges to connect with the consumer.” The event offers virtual sessions on March 20 and in-person sessions on March 21 on topics including: (1) Unlocking the Power of