Source: Ethical Corporation.

Search Results for: measure

MICROCAPITAL STORY: Reserve Bank of India (RBI) Deputy Governor States that nearly 50 percent of Farmer Households in India Still Have No Access to Credit; Calls for More Measures to Extend Financial Services in the Country

Nearly half of farmer households in India do not have access to credit either from the banks or other non-banking sources, said the Reserve Bank of India deputy governor Dr. K.C.Chakrabarty, speaking at a conference held recently in Chennai, India and focused on the theme ‘Banking: Key Driver for Inclusive Growth’. In his address, Dr. Chakrabarty pointed out that as per figures published by the National Sample Survey Organization (NSSO) in 2008, 45.9 million farmer households out of a total of 89.3 million households do not have access to credit either from the institutional or non-institutional sources and that as of NSSO’s 2007 figures, a single branch caters to the banking needs of a population of about 16,000 [2]. He also pointed out that for every 100 persons, there are only 17 credit accounts and 54 saving accounts with all institutions put together. Commenting on the sources of loans, Dr. Chakrabarty added that of the people having annual income less than Rs.50,000 (USD 1100), only 28.3 percent had bank accounts, with just 13 per cent availing loans from the banks and 53 per cent people still taking loans from the institutional and non-institutional sources only for emergency purposes. He pressed that the above facts underscore the ‘urgent need’ for extending the banking and financial services to every part of the country for achieving the objective of inclusive growth and that the recent focus of the RBI has been on providing access to affordable banking services to every person.

MICROCAPITAL PAPER WRAP-UP: Much Ado About Nothing: The Case of the Nigerian, Microfinance Policy Measures, Institutions and Operations, By B.O. Iganiga

Much Ado About Nothing: The Case of the Nigerian, Microfinance Policy Measures, Institutions and Operations; By B. O. Iganiga and published in The Journal of Social Science. The original paper is 13 pages and available here.

NEWS WIRE: Asian Development Bank Offers New Way to Measure Poverty in Asia

Source: Asian Development Bank (ADB).

PRESS RELEASE: Grameen Foundation Launches “Progress Out of Poverty” Website to Assist Microfinance Institutions’ Measurement of Social Performance

Source: Grameen Foundation.

MICROCAPITAL BRIEF: L-IFT Studying Fairness of Presumptive Taxation in Ethiopia

Low-income Financial Transformation (L-IFT), a firm with teams in 13 countries in Africa and Asia, recently reported on a study it is performing with data being collected over one year from 140 small businesses in Ethiopia. The study addresses the way the Ethiopian government taxes enterprises that bring in less than ETB 500,000 (USD 8,900) per year. Rather than asking the businesses to submit financial data, the Ministry of Finance estimates their income based on external characteristics. The goal of the study is to investigate “the accuracy of

Low-income Financial Transformation (L-IFT), a firm with teams in 13 countries in Africa and Asia, recently reported on a study it is performing with data being collected over one year from 140 small businesses in Ethiopia. The study addresses the way the Ethiopian government taxes enterprises that bring in less than ETB 500,000 (USD 8,900) per year. Rather than asking the businesses to submit financial data, the Ministry of Finance estimates their income based on external characteristics. The goal of the study is to investigate “the accuracy of

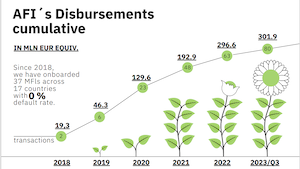

SPECIAL REPORT: Partner with Agents for Impact, and We’ll Drive Impact Together!

This article is sponsored by Agents for Impact (AFI). We invite you to learn more about the firm via LinkedIn.

Andrij Fetsun, Founder & CEO at AFI:

Andrij Fetsun, Founder & CEO at AFI:

AFI celebrated five years in business in October this year, and my team has attained several impactful goals during this challenging time. This would not have been possible without the immense support of our clients: the German impact-driven microfinance fund Invest in Visions, which has accumulated a volume of around EUR 1 billion with a major focus on microfinance; HANSAINVEST, which is based in Hamburg; and the crowdfunding platform Lendahand. Among the services we provide these clients is to perform plausibility checks of their funds’ ESG reports.

As the founder of AFI, I would like to highlight the culture we have built with our dedicated team that has come together during these five years from different parts of the world. I believe that corporate culture is crucial for every company, especially for startups. Initially, we had trouble attracting Agents since we were not a well-established name in the industry or able to pay high salaries from the outset. Therefore, I focused on what truly makes for a great workplace

As the founder of AFI, I would like to highlight the culture we have built with our dedicated team that has come together during these five years from different parts of the world. I believe that corporate culture is crucial for every company, especially for startups. Initially, we had trouble attracting Agents since we were not a well-established name in the industry or able to pay high salaries from the outset. Therefore, I focused on what truly makes for a great workplace

SPECIAL REPORT: European Microfinance Week 2023 Opens With Action Group Meetings, Including Investors Sharing Strategies for Measuring Social Performance #EMW2023

The first day of European Microfinance Week 2023 began this morning with meetings of several of the European Microfinance Platform’s (e-MFP’s) Action Groups. At the Investors Action Group session, Cécile Lapenu of CERISE discussed the recent increase in demand for accountability regarding claims of positive client impact. What really makes an investor an impact investor? How can we measure impact in a way that is convincing and also efficient?

The first day of European Microfinance Week 2023 began this morning with meetings of several of the European Microfinance Platform’s (e-MFP’s) Action Groups. At the Investors Action Group session, Cécile Lapenu of CERISE discussed the recent increase in demand for accountability regarding claims of positive client impact. What really makes an investor an impact investor? How can we measure impact in a way that is convincing and also efficient?

The recently published 60 Decibels Microfinance Index 2023 addresses some of these questions. The study, which is based on a survey of 32,000 microfinance clients in 32 countries, indicates that access to financial and non-financial services other than credit leads to deeper impact. Regarding credit services, group lending is associated with

SPECIAL REPORT: European Microfinance Week 2023 Is Almost Here! A Tour of the Upcoming Conference’s Sessions and Streams

European Microfinance Week (EMW) 2023, taking place in Luxembourg from 15-17 November, is fast approaching! One of the sector’s premier knowledge-sharing and networking events, EMW welcomes more than 500 professionals, in-person and online, and this year will comprise over 40 sessions – plenaries, breakouts, closed-door roundtables and Action Group meetings – organised across several thematic streams. These include: ‘Inclusive Finance for Food Security & Nutrition’, Green and Climate-smart Finance, Refugees and Forcibly Displaced Persons, Digitalisation, Investing, Financial Health, Client Protection, and Outcomes & Impact, among others. Here is a selection of what attendees can expect:

European Microfinance Week (EMW) 2023, taking place in Luxembourg from 15-17 November, is fast approaching! One of the sector’s premier knowledge-sharing and networking events, EMW welcomes more than 500 professionals, in-person and online, and this year will comprise over 40 sessions – plenaries, breakouts, closed-door roundtables and Action Group meetings – organised across several thematic streams. These include: ‘Inclusive Finance for Food Security & Nutrition’, Green and Climate-smart Finance, Refugees and Forcibly Displaced Persons, Digitalisation, Investing, Financial Health, Client Protection, and Outcomes & Impact, among others. Here is a selection of what attendees can expect:

‘Inclusive Finance for Food Security & Nutrition’ is the topic of the European Microfinance Award 2023, the €100,000 prize awarded annually by the Luxembourg Ministry of Foreign and European Affairs, which this year seeks to highlight innovations by financial services providers (FSPs) to safeguard access to quality and affordable food for vulnerable populations and to increase resilience of food systems. EMW2023 attendees will be able to choose from a range of sessions addressing the different dimensions of food security, including:

- An opening plenary to kick off this session stream, which will bring together different perspectives from key stakeholders to address holistically the current challenges in the field and discuss the role of FSPs in food security and building sustainable food systems;

- Creating Supportive Ecosystems to Maximize Supply of Agricultural Products Through Investments and Technical Assistance will focus on

MICROCAPITAL BRIEF: David Grimaud Named CEO of Palladium Group’s Bamboo Capital Partners

The Luxembourg-based fund manager Bamboo Capital Partners recently selected David Grimaud as its CEO, marking the departure of Jean-Philippe de Schrevel, the company’s founder. Mr Grimaud has a background in impact investing and asset management

The Luxembourg-based fund manager Bamboo Capital Partners recently selected David Grimaud as its CEO, marking the departure of Jean-Philippe de Schrevel, the company’s founder. Mr Grimaud has a background in impact investing and asset management

MICROFINANCE EVENT: Global Inclusive Finance Summit; December 12-13, 2023; New Delhi, India

This event, formerly known as the Inclusive Finance India Summit, is in its 20th year. The organizers expect 1,200 delegates to attend. While the agenda for this year has not been released yet, the 2022 iteration offered sessions such as:

This event, formerly known as the Inclusive Finance India Summit, is in its 20th year. The organizers expect 1,200 delegates to attend. While the agenda for this year has not been released yet, the 2022 iteration offered sessions such as:

SPECIAL REPORT: Inclusivity in Capital Markets Demands Sustainability Reporting

Sustainability reporting entails assessing, disclosing and managing an organization’s environmental, social and governance (ESG) impacts. This practice communicates to investors, customers, employees and regulators that the organization is committed to sustainability. The disclosure element, in particular, conveys values, strategies, risks, opportunities, accountability and transparency.

Sustainability reporting entails assessing, disclosing and managing an organization’s environmental, social and governance (ESG) impacts. This practice communicates to investors, customers, employees and regulators that the organization is committed to sustainability. The disclosure element, in particular, conveys values, strategies, risks, opportunities, accountability and transparency.

The significance of sustainability reporting within capital markets is increasing steadily, as more investors

SPECIAL REPORT: Let’s Channel Climate Finance to Those on the Climate Front

Climate finance is hot, and rightfully so. The threat is real, and the needs are towering. The good news is that there are investible solutions out there. As with any new field, the development of climate finance has been accompanied by a range of standards, taxonomies and metrics. For climate mitigation, a clear consensus seems to be emerging on emissions reductions as the preferred metric to be tracked by investors, however the jury is still out on the ideal standards for tracking the impact of climate adaptation, and it is only starting to deliberate on resilience projects.

Climate finance is hot, and rightfully so. The threat is real, and the needs are towering. The good news is that there are investible solutions out there. As with any new field, the development of climate finance has been accompanied by a range of standards, taxonomies and metrics. For climate mitigation, a clear consensus seems to be emerging on emissions reductions as the preferred metric to be tracked by investors, however the jury is still out on the ideal standards for tracking the impact of climate adaptation, and it is only starting to deliberate on resilience projects.

This difference in the pace of development of climate mitigation and adaptation standards has led to an unintended consequence: that the story of climate finance today is the story of climate mitigation. Less than 10 percent of all climate finance today goes to adaptation and resilience. This happens not because mitigation is more important than adaptation, but because the impact of mitigation projects is easier to track than that of adaptation projects. Simply put: what gets measured, gets managed.

The problem with too narrow of a focus on climate mitigation is that it does not take into account the fact that climate change is a challenge of livelihoods and social justice as much as it is an environmental challenge, especially for low-income populations and other vulnerable communities in the global South. Because climate change is not gender neutral, applying a gender (or JEDI for Justice, Equity, Diversity) approach to investments can

MICROFINANCE EVENT: Impact Minds: Standing Together; August 28-30, 2023; Rio de Janeiro, Brazil

This event will promote networking among impact ecosystem actors to facilitate the deployment of capital in Latin America and the Caribbean. On August 27, members of the Colombia-based network Latimpacto will meet for a pre-event dinner. The main event offers sessions titled: (1) The Role of the Multilaterals Acting as

This event will promote networking among impact ecosystem actors to facilitate the deployment of capital in Latin America and the Caribbean. On August 27, members of the Colombia-based network Latimpacto will meet for a pre-event dinner. The main event offers sessions titled: (1) The Role of the Multilaterals Acting as

MICROCAPITAL BRIEF: 60 Decibels Microfinance Index Data from 32 Countries Indicates Higher Confidence Among Group Borrowers, Greatest Debt Burden in Cambodia

This year’s second annual Microfinance Index from US-based impact measurement firm 60 Decibels draws on phone calls to approximately 32,000 users of microfinance services delivered by 115 financial services providers (FSPs) in 32 countries. In general, FSP clients reported higher confidence in dealing with economic shocks than

This year’s second annual Microfinance Index from US-based impact measurement firm 60 Decibels draws on phone calls to approximately 32,000 users of microfinance services delivered by 115 financial services providers (FSPs) in 32 countries. In general, FSP clients reported higher confidence in dealing with economic shocks than

MICROFINANCE EVENT: 2nd Annual Environmental Social Governance (ESG) Africa Conference; October 4-5, 2023; Sandton, South Africa

This conference offers opportunities to collaborate on incorporating environmental, social and corporate governance (ESG) goals into organizations’ operations. The themes are: (1) Investment and Financing; (2) Measurement and Reporting; (3) Governance, Leadership and Culture; and (4) Legal. The itinerary for Day One of the event includes

This conference offers opportunities to collaborate on incorporating environmental, social and corporate governance (ESG) goals into organizations’ operations. The themes are: (1) Investment and Financing; (2) Measurement and Reporting; (3) Governance, Leadership and Culture; and (4) Legal. The itinerary for Day One of the event includes

MICROFINANCE EVENT: Grow to Zero Conference; June 26-27, 2023; London, UK

Themed “Catalysing Finance for Impact,” this event will cover ways of leveraging blended finance, carbon markets and digitisation to enable transition to net-zero emissions and other forms of sustainable development. The agenda features sessions such as: (1) Challenges to 2030: How to Finance

Themed “Catalysing Finance for Impact,” this event will cover ways of leveraging blended finance, carbon markets and digitisation to enable transition to net-zero emissions and other forms of sustainable development. The agenda features sessions such as: (1) Challenges to 2030: How to Finance

MICROFINANCE PAPER WRAP-UP: “Impacts of Microcredit Access on Climate Change Adaptation Strategies Adoption and Rice Yield in Kwara State, Nigeria,” by Adejoke Yewande Bakare et al

Because 70 percent of Nigeria’s population is active in agriculture as a primary occupation, climate change has a direct impact on the livelihoods of most people in the country. Access to microcredit can

Because 70 percent of Nigeria’s population is active in agriculture as a primary occupation, climate change has a direct impact on the livelihoods of most people in the country. Access to microcredit can