Search Results for: Microfinance Institutions Bill India

MICROCAPITAL STORY: Legatum Invests $8.4m in Mumbai-based Microfinance Investment Consultant, Intellecap

Legatum Capital, a private firm that invests in global capital markets and social development initiatives, announced that it has invested USD 8.4 million (INR 34 crore or 340 million) in Intellecap, a company based out of Mumbai and Hyderabad, India which provides business advisory services to investors and organizations seeking both financial and social returns on investments. Among the services offered by Intellecap is Intellecash, a microfinance best practices franchise package that, according to the website, provides franchisees “with the information, systems, and processes that are required to start and manage profitable microfinance operations.” This is India’s first microfinance franchising initiative.

NEWS WIRE: IFC, FMO, and Deutsche Bank Invest in Aavishkaar Goodwell to Support Growth of Microfinance in India

Source: India PR Wire

Article available here.

IFC, a member of the World Bank Group, the Netherlands Development Finance Company (FMO), and Deutsche Bank today announced their joint investment in the microfinance private equity company Aavishkaar Goodwell. This investment will support the launch of up to 60 greenfield microfinance organizations and the expansion of up to 10 fast-growing microfinance institutions across India.

NEWS WIRE: India’s National Bank for Agriculture and Rural Development (NABARD) to Setup Microfinance Institution

Mumbai, May 28: Buoyed by the growing success of micro-finance movement in the country, National Bank for Agriculture and Rural Development (NABARD) has proposed to set up an institution for this purpose which would have a corpus of Rs 500 crore in three years.

The micro-finance institution, to be set up on a pilot basis, is aimed at providing easy credit to needy farmers who are now at the mercy of local money lenders. “I intend to start a micro-finance institution with the approval of my Board. Its a pilot project, initially the investment will not be very high but it will reach Rs 500 crore in three years,” NABARD Chairman Y S P Thorat said.

PRESS RELEASE: WOCCU Shares US Credit Union Insight with Self-help Groups in India

Madison, WI—Seated in front of a camera in Madison, Wisconsin, for the Digital Video Conference on Self-help Groups in India, Pete Crear, President and CEO of World Council of Credit Unions (WOCCU), shared insights from the US credit union experience in microfinance with Indian counterparts gathered in Chennai, India.

To date, microfinance in India has been focused almost exclusively on the provision of microcredit. As in other parts of the world, people there are recognizing that the poor need access to more than credit to work their way out of poverty.

PRESS RELEASE: Global Microfinance Leader PlaNet Finance Opens First U.S. Office in New York City

NEW YORK, May 15 /PRNewswire-USNewswire/ — PlaNet Finance, an international non-profit organization dedicated to alleviating poverty throughout the world through the development of microfinance, announced today the opening of its first U.S. office, in New York City.

Since its founding nine years ago in Paris, PlaNet Finance has grown to work in 60 countries including Madagascar, Mexico, Argentina, Israel, Mexico, Brazil, Senegal and China.

Is Anyone Home? India Looks to Bring Bureaucracy and Conflict of Interest to Microfinance by Putting the National Bank for Rural and Agricultural Development in Charge of Microfinance Regulation

The Union Cabinet of India cleared a bill, against substantial opposition, that will empower the National Bank for Rural and Agricultural Development (NABARD) to regulate the Indian microfinance sector. Only microfinance institutes (MFIs) operating in the form of trusts, societies and cooperatives will be controlled by NABARD, excluding non-bank financial institutions. This will require all such MFIs to register under the Microfinance Development Council (MDC), which will be a NABARD entity. The MDC will allow MFIs to raise savings only after getting specific approvals from the council. The creation of the MDC will also require the creation of a microfinance ombudsman as an appointed position.

Indian Government May Fix Microfinance Interest Rates

The Indian government is planning to set broad interest rate bands for microfinance institutions and self-help groups. Last week a group of ministers led by agriculture minister Sharad Pawar discussed the details of the proposed legislation. The legislation would spell out accountancy norms that microfinance institutions would follow. The bill will likely be presented in Parliament at the next Budget session.

Continue reading “Indian Government May Fix Microfinance Interest Rates”PRESS RELEASE: Deutsche Bank Examines the Attractiveness of Microfinance for Private Sector Investors

Source: Deutsche Bank.

Original press release available here.

ING Poised to Expand Microfinance Investment Activity Beyond India

ING Group is a Dutch company providing worldwide financial services including banking, insurance and asset management to clients in more than fifty countries. At the end of 2005, total assets were EUR 1,159 billion. As of April, 2006 ING was ranked as the 13th largest financial institution in the world based upon market value.

ING Vysya Bank Ltd, which became an ING subsidiary in 2002 when ING took over management of Vysya Bank Ltd, is the first International Indian Bank. Vysya reported assets of EUR 866 billion and net operating profit of EUR 5.97 billion at the end of 2005.

On the retail side, ING Vysya Bank provides group loans to villages in

Continue reading “ING Poised to Expand Microfinance Investment Activity Beyond India”

HSBC Shows Interest in Expanding Microfinance Investment Activity

Headquartered in London, HSBC is a large international banking network which includes 9,500 offices in 76 countries in Europe, the Asia-Pacific region, the Americas, the Middle East and Africa. At year-end 2005, HSBC reported total assets of approximately $1.5 trillion.

Currently, HSBC is engaged in several microfinance pilot projects with microfinance institutions (MFIs) in

Continue reading “HSBC Shows Interest in Expanding Microfinance Investment Activity”

International Banks and Their Expanding Role in Microfinance Investing

A new report by ING Bank, “A Billion to Gain? A study on global financial institutions and microfinance” takes a look at the emerging role of international commercial banks in the microfinance industry. ING Group is a Dutch company providing worldwide financial services including banking, insurance and asset management to clients in more than fifty countries. As of January, 2006 ING was ranked as the 13th largest financial institution in the world.

In the past year, spurred in part by the UN’s declaration of 2005 as the Year of Microcredit, many major international banks have announced initiation or expansion of microfinance-related activities. This has left some to wonder åö why the shift and what’s in it form them? Microfinance is a win-win situation åö it enables these banks to reach new markets while also creating a sense of goodwill. Over the course of the next several weeks åö we will be highlighting the microfinance activities of these major international players. To start things off, we’ll take a look at ABN AMRO VN. Headquartered in

Continue reading “International Banks and Their Expanding Role in Microfinance Investing”

Opportunity International Australia Lures Top Investment Manager for Work in Microfinance

Money Manager Chris Cuffe has gone from “riches to rags,” so to speak, leaving his post as Chief Executive of Challenger Financial Services Group’s Wealth Management business to become the Investment Services Director for Opportunity International Australia. Cuffe is best known in the investment world for his leadership of Colonial First State. Just a small start-up when he was brought on board, Cuffe left the company in 2003 after turning it into one of Australia’s leading fund managers with assets of more than $5 billion.

Opportunity International has been on the microfinance scene for over 35 years. The organization provides both funding for microfinance institutions and various training and support services for small businesses in developing countries. Worldwide, Opportunity International has 41 partner MFIs. Mr. Cuffe’s new role will involve managing the microfinance investments of the organization in Asia and Africa.

The addition of Mr. Cuffe’s business acumen to the microfinance world is a welcome part of a growing trend in the industry. As the pool of talented management in microfinance increases, so too will the pool of investment capital.

Additional Resources

1) “Cuffe Swaps Riches for Rags,” News.com.au, February 7, 2006

2) Opportunity International Australia

3) MicroCapital Blog: “Microfinance Invests in India’s Top Minds,” January 24, 2006

4) MicroCapital Blog: "Fremont Bank Makes $500,000 Investment in Opportunity International Loan Guarantee Fund," November 3, 2005

5) Opportunity International Network

Has ACCIÌãN Opened the Gates’ To Microfinance Investing?

ACCIÌãN International announced today that it has received a US$5.8 million grant from the Bill & Melinda Gates Foundation. The grant will be used primarily to develop new partnerships with microfinance institutions and commercial banks in West Africa and India.

Continue reading “Has ACCIÌãN Opened the Gates’ To Microfinance Investing?”

Deutsche Bank Leads New Global Commercial Microfinance Consortium, a $75 Million Microfinance Investment Fund

Just recently, a group of private and public sector institutional investors and economic development agencies launched the

Investors include Merrill Lynch, AXA Group, HP, and the Calvert Social Investment Foundation. For a full list of investors visit: “Leading Institutions Investors and Development Agencies Launch the Global Commercial Microfinance Consortium.” Deutsche Bank, a full global financial services company with å¥972 billion in assets, led the arrangements to establish the fund and also facilitated its sale.

This Consortium is “microcapital” at its best. First, expert management by Deutsche Bank’s long-established and well-respected microfinance unit provides the leadership. Second, the investor group mixes mainstream investment banks, rational development agencies, and flagship social investment foundations. Third, the role of government as guarantor uses your tax dollars to support (not execute) for-profit, private innovation. Fourth, the fund investment in MFIs is well-diversified across countries, regions and types of MFIs.

With such leadership and innovation, we might one day soon establish a secure asset class for the investing public.

Additional Resources

1) Main article discussed in entry, Thames Techwire: “Group Unveils å¥63 Million ‘Micro-Entrepreneur’ Fund.”

2) “Leading Institutional Investors and Development Agencies Launch the Global Commercial Microfinance Consortium.”

3) “Global Commercial Microfinance Consortium.”

4) U.S. Agency for International Development (USAID) Press Release: “USAID, Private-Sector Partners Create Global Fund for Small Entrepreneurs and Low-Income Families: Agency Provides $15 Million Credit Guarantee to Fund Aimed at Alleviating Poverty."

Current Trends in Microfinance: The Growth of Commercial Microfinance

Downsizing of commercial banks, greater number of partnerships, increasing amount of local currency deposits, and the integration of the commercial and microfinance sectors—all current trends—are tightly linked.

As commercial banks have realized that poor people’s finance can be profitable, an increasing number have gone down market to tap lower income clientele. The World Bank’s microfinance unit, the Consultative Group to Assist the Poor, estimates that there are currently around 225 commercial banks “engaged in microfinance”— a figure that is increasing.

The main reasons for the emergence of commercial banks at the low-income level are: 1) Competition in existing markets driving banks into new ones, 2) Excellent repayment rates by micro-entrepreneurs, and 3) Technology allowing the poor greater access while transactions remain cost-effective. Though governments in some developing countries have required commercial banks to work in certain sectors, banks are increasingly lured in by the low risk, stability, and potential growth opportunities in the microfinance market. They are entering either directly by utilizing their own resources such as an internal microfinance unit, or with existing providers through partnerships.

Partnerships between MFIs and commercial banks have enabled each to leverage their competitive advantages. While MFIs are more knowledgeable at the community level for instance, banks have the advantage in greater access to capital and existing infrastructure. The meeting of the commercial and microfinance sectors has come about through their collaboration. MFIs have scaled up to “access higher levels of credit, augment their portfolios, and strengthen management and efficiency levels,” while commercial banks have purposely scaled down to profit from this emerging industry. Both types of institutions “scale-up and scale-down” by redesigning their financial products to suite the clientele they are targeting.

Integration between these sectors leads to another current trend in microfinance—the increase in deposits as a source of funding. It is important for MFIs to turn from foreign debt investment, which is vulnerable to foreign exchange risk, to their own domestic and regional markets so that domestic savings can be transformed into “productive loans for the poor.” Due to limited knowledge and a lack of trust beyond the community, the local poor may therefore be more inclined to make deposits into local savings accounts. Within the last year for instance, the number of accessible savings and loan accounts among the poor has gone from 750 million to 1.4 billion. Furthermore, and importantly, foreign currency risk can be avoided when MFIs borrow and lend in the local denomination.

One of the main links between these trends is technological advancement. Efficient technology has allowed smaller and simpler banking transactions to become more cost effective, motivating commercial banks to scale down and reach a greater number of people. Low cost ATMS with picture and voice prompts for example, are bringing in rural and illiterate clientele. An in-country example is the State Bank of

Additional Resources

1) Main article discussed in entry, United Nations Capital Development Fund (UNCDF): “Microfinance—Where We Are Now: And Where We Are Headed.”

2) The Consultative Group to Assist the Poor (CGAP): “Commercial Banks and Microfinance: Evolving Models of Success.”

3) “Microfinance Sustainability through Private Sector Partnership.”

4) Inter American Development Bank (IADB): “Savings Becomes First Source of Funding for Microfinance.”

5) “Managing Foreign Exchange Risk: The Search for an Innovation to Lower Costs to Poor People.”

6) “Microfinance: Facts and Figures.”

7) “Financial Institutions with a ‘Double Bottom Line’: Implications for the Future of Microfinance.”

8) “WSBI’s Contribution to the Collection of Data on Accessible Finance: Telling the Supply Side of the Story.”

Microfinance Blazes Trail for Bringing Goods to Rural India

Even though 70% of

Rural Indian markets, whose potential has historically been dismissed, house 700 million people and account for more than 50% of fast-moving consumer good (FMCG) sales, and 60% of the durables market. The annual size of the rural market for FMCGs has been steadily growing and is estimated at $11 billion (pg. 3).

The shift to rural markets has only recently begun in full force as companies have realized that it is too costly to ignore this market any longer. While the per capita income of rural

In overcoming the difficulties of penetrating rural markets, companies are turning to the rural poor not only as potential consumers, but as retailers as well. Collaborating with microcredit clients has proven to be good business.

The most revolutionary example of such partnership is between Indian company Hindustan Lever Limited (HLL), a subsidiary of Unilever, and CARE India’s multi-state microfinance program. By linking HLL with self-help groups throughout

The joint venture, named Project Shakti, has already expanded to 12 states and aims to include 40,000 (up from 16,000) women by next year. By penetrating rural markets through access points such as microfinance institutions, an important catalyst to increase scale is emerging, with immense potential for future growth.

Additional Resources

1) Main article discussed in entry, Wall Street Journal: "With Loans, Poor South Asian Women Turn Entrepreneurial."

2) "HLL Inks Strategic Alliance with CARE India."

3) Book Review: "The Fortune at the Bottom of the Pyramid," C.K. Prahalad

4) Financial Express: "Competing Visions of Rural India."

SPECIAL REPORT: Partner with Agents for Impact, and We’ll Drive Impact Together!

This article is sponsored by Agents for Impact (AFI). We invite you to learn more about the firm via LinkedIn.

Andrij Fetsun, Founder & CEO at AFI:

Andrij Fetsun, Founder & CEO at AFI:

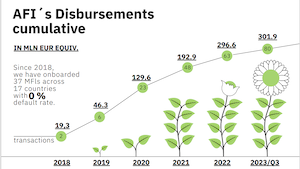

AFI celebrated five years in business in October this year, and my team has attained several impactful goals during this challenging time. This would not have been possible without the immense support of our clients: the German impact-driven microfinance fund Invest in Visions, which has accumulated a volume of around EUR 1 billion with a major focus on microfinance; HANSAINVEST, which is based in Hamburg; and the crowdfunding platform Lendahand. Among the services we provide these clients is to perform plausibility checks of their funds’ ESG reports.

As the founder of AFI, I would like to highlight the culture we have built with our dedicated team that has come together during these five years from different parts of the world. I believe that corporate culture is crucial for every company, especially for startups. Initially, we had trouble attracting Agents since we were not a well-established name in the industry or able to pay high salaries from the outset. Therefore, I focused on what truly makes for a great workplace

As the founder of AFI, I would like to highlight the culture we have built with our dedicated team that has come together during these five years from different parts of the world. I believe that corporate culture is crucial for every company, especially for startups. Initially, we had trouble attracting Agents since we were not a well-established name in the industry or able to pay high salaries from the outset. Therefore, I focused on what truly makes for a great workplace